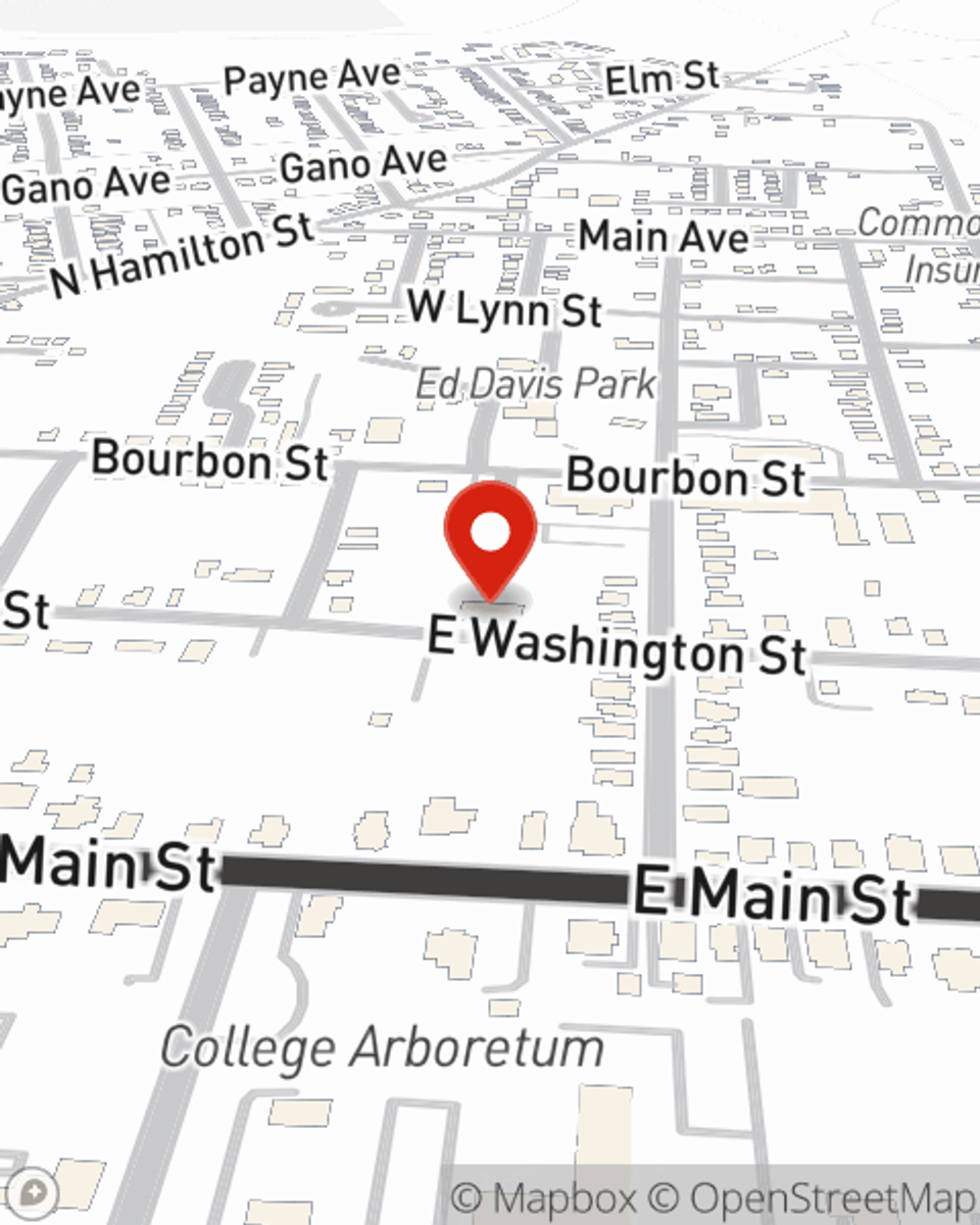

Business Insurance in and around Georgetown

Get your Georgetown business covered, right here!

Cover all the bases for your small business

This Coverage Is Worth It.

Small business owners like you have a lot on your plate. From inventory manager to customer service rep, you do everything you can each day to make your business a success. Are you a real estate agent, a barber or a podiatrist? Do you own an appliance store, an art gallery or a beauty salon? Whatever you do, State Farm may have small business insurance to cover it.

Get your Georgetown business covered, right here!

Cover all the bases for your small business

Get Down To Business With State Farm

When one is as driven about their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for worker’s compensation, artisan and service contractors, surety and fidelity bonds, and more.

Let's talk business! Call Grant Rea today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Grant Rea

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.